There are significant differences between Sleek cans and slim cans in terms of capacity, size, applicable beverage types, and market share. The following is a detailed analysis:

I. Differences in Capacity and Size

● Capacity Range

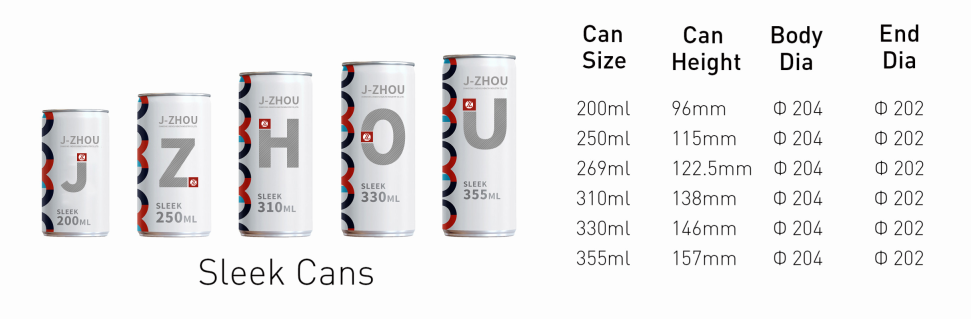

Sleek can: It has a wider capacity range, with common specifications including 200ml, 250ml, 269ml, 310ml, 330ml, and 355ml. For example, Schweppes soda water and cherry-flavored Coca-Cola are both packaged in 330ml sleek cans.

Slim can: It has a relatively smaller capacity, mainly including 185ml and 250ml, with some brands offering 310ml specifications. For instance, Perrier sparkling water’s slim can is 250ml (8.45 ounces).

![sleek can sleek can]()

● Size Design

Sleek can: The can body diameter is 204 (approximately 57.4mm), and the height varies by capacity. For example, a 250ml sleek can is about 115mm in height, and a 355ml one is approximately 156.6mm. Its design emphasizes smooth curves and features a larger label area, making it suitable for displaying brand visual elements.

Slim can: The can body diameter is 202 (approximately 53.4mm) with a greater height. For example, a 250ml slim can is about 134mm tall, and a 310ml one is around 158mm. Its slim profile makes it more convenient to hold, especially suitable for one-handed drinking.

![slim can-2]()

II. Applicable Beverage Types

● Sleek can

Main applications: Carbonated drinks (e.g., Coca-Cola, soda water), beer, coffee, fruit juice, etc. For example, RITA Beverages’ American coffee and mixed fruit juices are packaged in sleek cans.

Advantageous scenarios: Beverages requiring large capacity or emphasizing brand design, such as 355ml standard carbonated drink cans and 500ml beer cans.

![collection aluminum can collection aluminum can]()

●Slim can

Main applications: Energy drinks (e.g., Red Bull), ready-to-drink tea, high-end alcoholic beverages (e.g., craft beer, wine), functional drinks, etc. For example, Seagram’s Escapes and Heineken have both launched slim can versions to attract young consumers.

Advantageous scenarios: Beverages emphasizing portability and a premium feel, such as sports drinks and ready-to-drink coffee.

III. Market Share and Regional Distribution

● Global Market Trends

Sleek can: It holds a significant share in the Asian and European markets. For example, over 70% of aluminum cans in Japan, South Korea, and Southeast Asian regions are sleek or slim cans, while 80% in Europe are sleek cans. In the global aluminum can market by 2025, sleek and slim cans are expected to dominate, with a market size reaching 53.52 billion USD.

Slim can: It is growing rapidly in North America and Europe. In the European market, slim cans account for 15% of total aluminum cans, mainly used for energy drinks (70% of this share). Manufacturers like Ball Corporation produce 150-250ml slim cans in Europe, covering categories such as tea and beer.

China Market Dynamics

Growth forecast: By 2025, sleek and slim cans are expected to account for 75% of total aluminum cans in China, while regular cans will only make up 15%. Carbonated drinks and tea beverages are the main drivers, accounting for 55% and 35% of the market share respectively.

Competitive landscape: Local enterprises such as Orion and Baosteel Packaging compete fiercely with international giants (e.g., Ball Corporation), with the top five manufacturers occupying 70% of the market share.

● Regional Preference Differences

North America: Due to meeting the demand for sports drinks and energy drinks, the market share of slim cans continues to rise. The aluminum can market size in North America is expected to reach 50 billion USD by 2025.

Europe: Sleek cans are more popular, especially in the beer and high-end beverage sectors. For example, Heineken and craft beer brands widely use sleek cans.

Asia-Pacific: Emerging markets such as China and India are driving the growth of sleek and slim cans. The compound annual growth rate (CAGR) of the Asia-Pacific aluminum can market is expected to exceed 5% from 2025 to 2030.

IV. Key Manufacturers and Market Strategies

● Major Manufacturers

Ball Corporation: One of the world's largest aluminum can manufacturers, with slim can production capacity covering Europe and North America. Its 250ml slim cans are used for energy drinks and tea.

Ardagh Group: Launched lightweight slim cans to reduce carbon emissions, while expanding its sleek can product line to meet diversified needs.

Chinese enterprises: Chinese companies like Orion and Baosteel Packaging are seizing the carbonated drink and beer markets through customized sleek cans (e.g., 330ml and 500ml).

● Market Competition Strategies

Differentiated design: Sleek cans enhance brand recognition through a large label area (e.g., Coca-Cola’s replicated design of the curved bottle body), while slim cans attract young groups with their slim profile.

Sustainability: Both manufacturers promote recyclable aluminum materials. For example, the recycling rate of Shandong Jinzhou’s slim cans exceeds 95%, in line with the trend of environmental regulations.

Summary

The differences between sleek cans and slim cans stem from capacity needs, design positioning, and market strategies. Sleek cans dominate the carbonated drink and beer markets by virtue of their large capacity and visual advantages, while slim cans have a place in the energy drink and ready-to-drink tea sectors with their portability and premium feel. By 2025, both are expected to dominate the global aluminum can market, with significant growth in the Asia-Pacific and European markets, while the North American market shows a trend of rapid penetration of slim cans.

Shandong Jinzhou Health Industry Co., Ltd aluminum can customization: sizes tailored to needs, with main series including sleek cans, standard cans and slim cans, and capacities ranging from 190ml to 1000ml. 7-color printing available, with Glossy/Matte/White Base/Tactile finishes optional.Highlight uniqueness—click to leave your information and get an exclusive solution!