![2025 Beer and Beverage Trends]()

The beverage industry will grow fast in 2025. New packaging and changing customer needs help this growth.

Market Segment | Projected CAGR (2025 onwards) | Notes |

Global Beverages Can | ~5.5% (2025-2034) | Eco-friendly packaging and ready-to-drink demand lead growth. |

Canned Alcoholic Beverages | 11.73% (2025-2034) | Convenience fuels strong demand, especially in North America. |

Beverage cans are leading this change. They are light and easy to recycle. Companies use smart packaging and better materials. This attracts people who care about health. These cans help the planet and keep drinks fresh and good. Brands use them to give high-quality drinks.

Key Takeaways

Beverage cans are becoming more popular. They are light and good for the environment. Cans keep drinks fresh. This makes them liked all over the world.

People want drinks that are healthy and natural. Many people pick drinks with less sugar. Some choose premium, craft, and non-alcoholic beers. They want better taste and to feel well.

New can designs and sizes are coming out. Mini and slim cans are easy to use and look cool. These cans help brands get noticed by younger people.

Caring for the planet affects packaging choices. Companies use recycled materials and lighter cans. This helps cut down on waste and pollution.

Online shopping helps sell more drinks. Strong packaging and clear labels help customers choose drinks. People pick drinks that match their lifestyle and what they care about.

Market Overview

Market Data

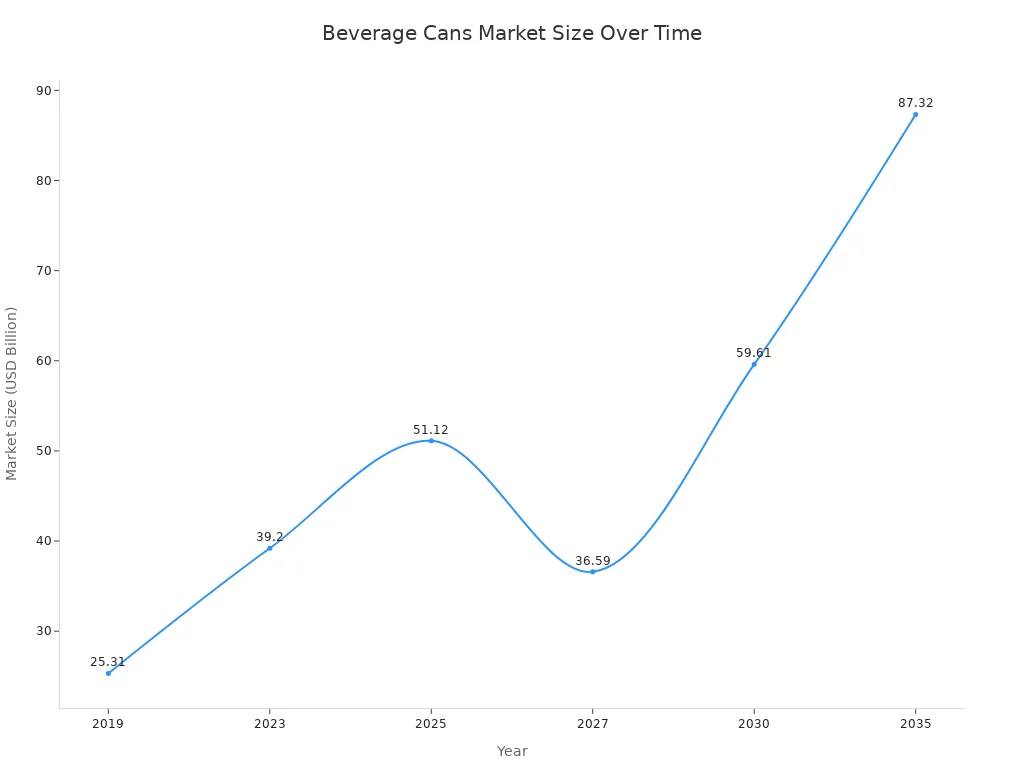

The beverage packaging business is getting bigger. Companies are changing how they make packages because people want new things. Experts think beverage cans and metal packaging will grow a lot. The table below shows important numbers:

Metric | Value (USD Billion) | Year/Period | CAGR (%) |

Beverage Cans Market Size | 39.20 | 2023 | - |

Projected Market Size | 59.61 | 2030 | 5.5 (2024-2030) |

Alternative Forecast Market Size | 51.12 | 2025 | - |

Alternative Projected Size | 87.32 | 2035 | 5.5 (2025-2035) |

Food & Beverage Metal Cans Market | 57.79 | 2025 | - |

Projected Metal Cans Market Size | 108.96 | 2034 | 7.3 (2025-2034) |

![Line chart showing beverage cans market size from 2019 to 2035]()

Experts say beverage cans now make up about half the money in this area. Metal cans and paper-based packaging are getting more popular. Companies want to use things that are better for the planet. Plastic and glass packaging are not growing as fast. This is because people worry about the environment and recycling is hard.

Consumer Shifts

People want packaging that is safe and good for the earth. They also want it to be easy to recycle. Many people do not like too much packaging. Brands use less material and pick eco-friendly choices. Metal cans and paperboard are popular because they are easy to recycle and better for nature.

63% of people think plastic packaging hurts the ocean.

58% are more likely to buy things with reusable or recyclable packaging.

79% like refillable packaging claims.

Most people, about 82%, say safety and the environment are most important when picking packaging. Beverage companies buy new machines to help make better packaging. Paper-based packaging and flexible types are growing fast. Rigid plastic and glass are used less now. Aluminum cans are special because they are easy to recycle and use less energy. Glass is still liked for safety but is hard to move and causes more pollution. Brands now tell people about their new packaging. This helps shoppers choose better. More online shopping means people want strong and earth-friendly packaging.

Beer Trends

![Beer Trends]()

Premiumization

Premiumization is changing beer around the world in 2025. More people want craft and high-quality beers. Young adults want real, different, and better-tasting beer. The premium part of the market is growing fast. About 70% of beer drinking will be premium or super-premium brands. This is happening in rich and growing countries. Cities are getting bigger and people have more money in places like India, Brazil, and China.

Trend Aspect | Description |

Consumer Preference | People want craft and premium beers for taste and quality. Young adults like these beers the most. |

Market Share | Premium beers will be the biggest part of the market. This is because of good ingredients and more people with money. |

Flavor Innovation | Breweries make new flavors to please millennials who want something new. |

Packaging Preferences | Glass bottles look fancy and eco-friendly. Cans are liked in rich countries because they keep beer fresh and are easy to use. |

Health & Novelty Appeal | Young people pick premium alcohol for health and new tastes. |

Regional Expansion | More microbreweries and taprooms are opening in North America, Europe, and Asia-Pacific. This helps premiumization grow. |

Breweries do more than just sell beer now. They make fun experiences and use smart marketing. Big brands like Anheuser-Busch InBev and Heineken build new places and use data to sell better. Carlsberg is making non-alcoholic and soft drinks too. Many brands use green methods to get health-focused buyers.

Beverage cans are important for premiumization. Cans keep beer fresh by blocking light and air. They are easy to recycle and move. This makes cans popular in many places. Cans help breweries give people good beer in an easy way.

Flavor Innovation

Flavor matters most to beer drinkers. A recent poll says 92% of craft beer fans care most about flavor. Brewers make new and bold flavors to keep people interested. Crisp, juicy, hazy, and fruity beers are very popular now. Tart, spicy, and dark beers are not as common.

Aspect | Evidence | Impact on Consumer Preferences and Industry |

Flavor Importance | 92% of craft beer fans say flavor is most important (2024 Harris Poll) | Flavor shapes what beer people choose. |

Popular Flavor Profiles | Crisp, juicy, hazy, and fruity beers are popular. Tart, spicy, and dark beers are less liked. | People want bold, easy-to-like flavors. Brewers make more of these. |

Brewer Response | Brewers keep making new flavors and special releases. | This keeps people interested and loyal to brands. |

Market Strategy | Breweries focus on new flavors and healthy choices. | This helps brands stand out and compete. |

Brewers use many new things and ways to make beer:

Botanical and herbal infusions like lavender and chamomile add new tastes.

Special yeast makes tropical fruit and clove flavors.

Flavors from food like peanut butter, chili, cacao, and coffee surprise people.

Fruit and citrus like grapefruit and blood orange are still favorites.

Clean-label trends mean more natural, low-sugar, and no-additive beers.

Some styles mix tea, coffee, botanicals, and have low or no alcohol.

Flavors like mango, peach, and iced tea will be big. Mexican lagers are getting more popular because of food trends. Beers with less alcohol and fewer calories are liked by young workers and older adults. Seasonal and import-inspired beers, like Euro-style and Japanese-style lagers, are also showing up.

Beverage cans help keep these new flavors fresh. Cans block light and air, so beer stays good and does not taste bad. Cans also keep bubbles in and stop spoilage. Brewers use cans for small batches and special beers. This makes it easy to try new ideas.

Non-Alcoholic Options

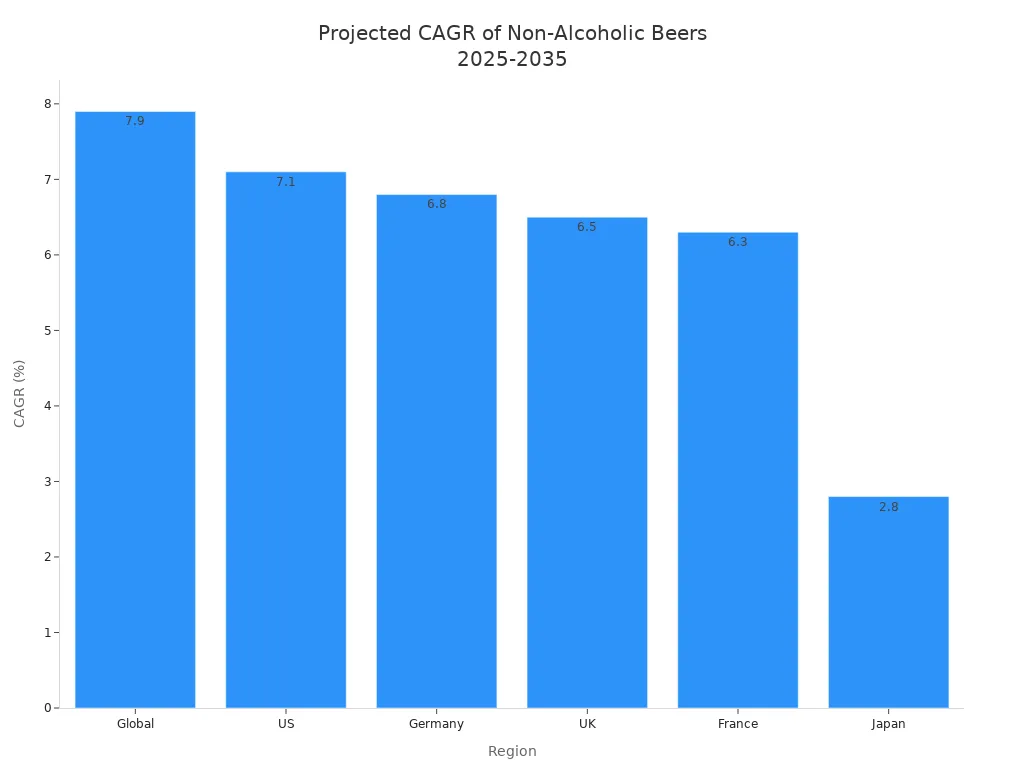

Non-alcoholic and functional beers are growing fast. The world market for non-alcoholic beer will be $20.5 billion in 2025. It could double by 2035. This group is growing by 7.9% each year. Flavored non-alcoholic beers are more than half the market.

![Bar chart comparing projected CAGR for non-alcoholic beers in global and key markets from 2025 to 2035]()

Younger people, like Gen Z and Millennials, lead this trend. Many pick non-alcoholic versions of beers they like. They want to be healthy, avoid hangovers, and save money. Non-alcoholic beer is now most of the non-alcoholic drink sales in the U.S. More people accept these drinks, and more places sell them.

Brewers make non-alcoholic beers taste better and feel higher quality. Big brands like Heineken and Guinness spend money on this area. Functional beers with extra botanicals or health boosts are also liked. The market is getting bigger, with more craft and small brands joining.

Beverage cans help non-alcoholic and functional beers grow. Cans protect the flavors and make it easy to send these beers everywhere. Cans also keep beer fresh and safe while moving.

Beverage Cans

![Beverage Cans]()

Sustainability

Sustainability is very important in beverage packaging today. Makers use lighter and stronger materials for cans now. This means they need less metal and shipping makes less pollution. Many companies use more recycled aluminum to save energy and cut waste. Recycled aluminum uses only 5% of the energy needed for new aluminum. This helps save natural resources.

Factories that save energy are also important. Automation and artificial intelligence make production faster and greener. New can designs help make recycling easier. Mono-material packaging and better sorting let cans be recycled many times.

Note: The average aluminum can is now over 40% lighter than before. This has lowered the carbon footprint of beverage packaging.

Sustainable actions go beyond just the can. Some brands use biodegradable rings or wrap cans in recycled cardboard. Others have take-back programs for plastic carriers or sell loose cans to use less packaging. These steps help cut plastic waste and support a circular economy.

Lightweighting saves up to 10% of metal in each can.

Drawn and Wall Iron (DWI) cans use less material but stay strong.

New adhesives and easy-open ends make recycling simpler.

Companies use renewable energy and water-saving methods.

Design Innovation

Design innovation changes how people see and use beverage cans. Cans used to be heavy and made from three pieces of metal. Now they are light and easy to open. Aluminum cans and pull-tabs made cans safer and easier to use. Stay-on tabs, colored ends, and shaped cans add style and function.

Brands use design to stand out from others. They pick shapes like slim or curved cans to look fancy or strong. Bright colors are for energy drinks and dark colors are for premium beers. Labels can be simple or bold to help brands tell their story.

Beverage cans are more than just good-looking. Some cans have matte or shiny finishes, textures, or foils. These features make products feel special and get attention in stores. Some brands use 360-degree printing for cool designs. Others print under the tab for promotions or use resealable tops for convenience.

Tip: Cool can designs help brands connect with younger buyers who want products that fit their lifestyle.

New technology may soon bring cans with LED displays or NFC chips. These changes make beverage cans fun and interesting.

New Formats

New beverage can formats fit different people's needs. Now, cans come in many sizes and shapes. There are mini 7.5 oz cans for small drinks and big 32 oz crowlers for sharing. Slim and sleek cans look modern and feel premium. Standard 12 oz cans are still popular for sodas and beers.

Can Size | Typical Use Cases | Consumer Appeal and Market Positioning |

7.5 oz (Mini Can) | Kids’ drinks, sugar-free sodas | Portion control, health focus |

8.4 oz (Energy Can) | Energy drinks, cold brew | Sleek, portable, urban style |

12 oz (Standard Can) | Sodas, beers, teas | Versatile, widely used |

12 oz Slim/Sleek Can | Hard seltzer, kombucha | Modern, premium look |

16 oz (Tallboy) | Craft beers, iced coffee | Creative labels, craft appeal |

19.2 oz (Stovepipe) | Convenience store beers | Single-serve, events |

24 oz (Oil Can) | Value beers | Bulk, cost-effective |

32 oz (Crowler) | Draft beer, craft releases | Sharing, freshness |

64 oz (Growler) | Taprooms, group use | Multi-person, brand story |

People like these new formats for many reasons. Over 65% think cans are the most eco-friendly choice. About 78% like cans because they are easy to use. Resealable cans let people drink at their own pace and keep leftovers fresh. High-definition printing and embossed textures make cans look and feel better.

Beverage cans now work for many drinks, like ready-to-drink cocktails, protein shakes, and kombucha. These formats help with sustainability, convenience, and style. Brands use them to reach new customers and give more choices.

Market Drivers

E-Commerce

E-commerce is changing how people buy drinks in 2025. More people shop online now. Sales are going up by 18.2% to $11.9 billion. Brands use websites to give people what they want. People want things that are easy, healthy, and good for the planet. Many companies sell single-serve cans and subscriptions online. This helps shoppers try new drinks and get them at home.

E-commerce lets brands reach more people online. They use websites and direct sales. About 86% of sales come from people who shop both online and in stores.

Digital tools like artificial intelligence help companies track stock. They can guess what customers want. This means faster delivery and less waste.

Social media, like TikTok, helps brands get noticed. Fun videos and trends make people want to buy drinks online.

Online shopping makes it easy to see if packaging is eco-friendly. Shoppers can check if cans use recycled materials.

Packaging is very important online. For many people, the package is the first thing they see or touch. About 47% feel excited by special unboxing. 41% will buy again because of it.

Online shopping changes how cans look and work:

Health trends make brands use clear labels and healthy words.

People want less sugar, so cans show low or no sugar.

Multi-functional drinks need labels that explain their benefits.

Cans must be strong for shipping and easy to open.

Many shoppers want cans that are easy to recycle.

Regional Trends

Regional trends affect how cans grow in different places. The table below shows what matters in each region:

Region | Key Drivers and Trends |

North America | Energy drinks, spiked seltzers, canned cocktails, flavored waters grow. 75% of new drinks use cans. |

Mexico | 80% of cans are for beer. People use less returnable glass. |

Brazil | Beer cans grew from 48% in 2015 to 64% in 2022. |

Europe | Cans are popular. Growth comes from eco-friendly choices, off-premise sales, and fancy designs. |

Southeast Asia | Growth comes from more money, young people, eco-friendly ideas, and smaller drinks. |

Africa & Middle East | Growth comes from more cities, new trends, and more people liking cans. |

Asia Pacific | This is the fastest-growing market. |

Asia-Pacific is growing the fastest. Cities are getting bigger and more people have money in China and India. The Middle East and Africa are also growing. Young people and better economies help this growth. North America and Europe are still big markets, but they grow slower. Young people like energy drinks and canned cocktails. This makes more brands use cans. Aluminum cans are liked because they are light, easy to recycle, and good for the earth.

Consumer Trends

Wellness

People in 2025 care a lot about healthy drinks. They want drinks with no sugar and low calories. Many drinks have extra health benefits now. Drinks with electrolytes, vitamins, probiotics, and protein are popular. Most people like natural flavors and do not want fake ingredients. The clean label trend is getting bigger as shoppers want to know what is inside. Non-alcoholic and low-alcohol drinks are good for people who want to drink less. Ready-to-drink cocktails, hop water, and flavored powders are common now. Gen Z likes brands that help with wellness and careful drinking. People drink more water, use refillable bottles, and try beverage enhancers. Drinks for brain health and focus with nootropics are getting noticed. People do not trust fake health claims and pick drinks with real proof.

Tip: Brands that use clear labels and natural things earn trust from healthy shoppers.

Nostalgia

Nostalgia affects what drinks people pick. Old flavors and brands from childhood make people happy. More than 40% say they choose drinks because of nostalgic flavors. Young people, like Gen Z and millennials, love these old tastes. Pop culture and old products help people feel connected. Brands use old flavors in new drinks to get noticed and keep customers.

Aspect | Evidence Summary |

Consumer Influence | Over 40% say old flavors matter; 52% of ages 12-29 like classic brands. |

Neuroscience Connection | Taste and smell remind people of good memories. |

Generational Appeal | Gen Z and millennials want childhood flavors when times are hard. |

Marketing Strategies | Brands mix old flavors with new styles to make people feel good. |

Mood and Comfort | Nostalgia helps people feel better, especially when the world is tough. |

Community

Community trends change how brands talk to people. Companies stand for causes and have their own style. Social media like TikTok and Instagram help brands talk to fans. Working with influencers helps brands reach more people and seem real. Being open about helping the planet builds trust. When people share photos or reviews, it makes brands look honest and helps sales. Brands have events, give special experiences, and sell limited products to make things exciting.

Social media helps people find and talk about new drinks.

Healthy shoppers want good-for-you drinks and fair actions.

Brands use local ingredients and care for the earth to keep fans.

Festivals, pop-ups, and team-ups help people feel close to brands.

Note: Brands that let people join in and share their values get more fans and keep them longer.

Beverage cans are changing drinks in 2025. Brewers and brands notice more people want healthy, sessionable, and non-alcoholic drinks. Shoppers look for high quality, good value, and fun new choices. Companies deal with higher prices and new laws. But new technology and smart ads help them find new chances. The market changes fast and helps those who act quickly and care about both the planet and new ideas.

FAQ

What makes beverage cans more sustainable than plastic or glass?

Aluminum cans use less energy to recycle. Most cans contain recycled material. They are lighter than glass, which lowers shipping pollution. People recycle cans more often than plastic bottles.

Why do brands choose cans for new drink flavors?

Cans protect flavors from light and air. This keeps drinks fresh. Cans also allow brands to use bright designs and special printing. Many people like the look and feel of cans.

Are non-alcoholic beers as popular as regular beers?

Non-alcoholic beers are growing fast. Many young people choose them for health reasons. Big brands and craft brewers now make more non-alcoholic options. These beers taste better than before.

How do beverage cans help with online sales?

Cans are strong and easy to ship. They do not break like glass. Brands use cans for single-serve and multi-pack options. This makes it simple for people to try new drinks from online stores.

What new can formats are popular in 2025?

Mini cans, slim cans, and large crowlers are popular. People like small cans for portion control. Tall cans work well for craft beers. New shapes and sizes help brands reach more customers.